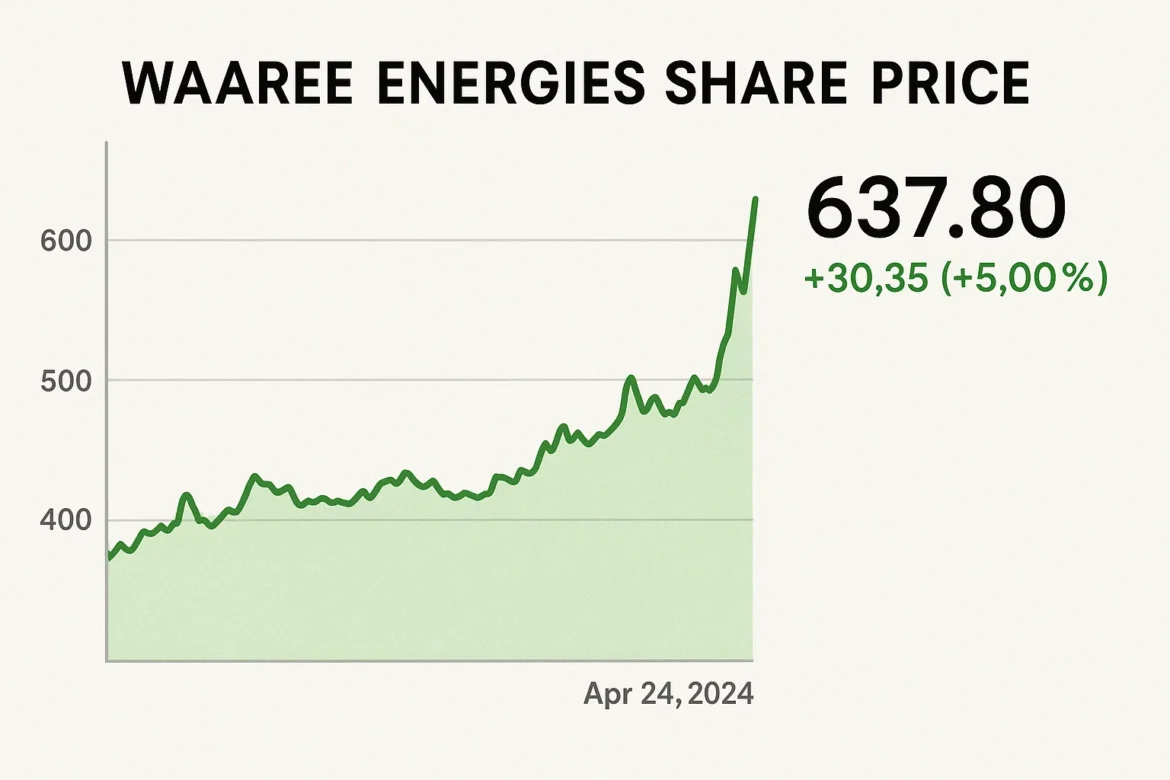

Introduction to Waaree Energies and Its Market Presence

Waaree Energies has emerged as one of the most recognized names in India’s renewable energy sector, particularly in the solar energy industry. Known for its innovation, large-scale manufacturing capabilities, and strong market presence, the company has attracted significant attention from investors and analysts alike. Among the various aspects that traders closely observe, the waaree energies share price remains one of the most discussed topics.

For investors, monitoring the stock performance offers valuable insight into the company’s financial health, market potential, and long-term prospects. As renewable energy becomes a global necessity rather than a choice, Waaree Energies is well-positioned to benefit, and its share price reflects this optimism.

Overview of Waaree Energies’ Business Model

To understand the fluctuations in the waaree energies share price, it is essential to study the company’s business model. Waaree Energies primarily focuses on solar photovoltaic (PV) modules, EPC services, rooftop solutions, and other clean energy-related products. It has one of the largest solar PV module manufacturing capacities in India, making it a key player not just domestically but also in international markets.

The demand for solar modules is rising, and the company’s ability to meet both quality and scale requirements enhances its competitive edge. Investors view this business model as sustainable and forward-looking, thereby creating direct implications for the share price performance.

Global Renewable Energy Context and Its Impact on Waaree Energies

The renewable energy sector is experiencing an unprecedented boom, fueled by climate change concerns, government incentives, and global sustainability goals. Countries around the world are aiming for carbon neutrality, which has directly increased the demand for solar energy solutions. As Waaree Energies continues to expand its capacity and market share, these global dynamics play a role in influencing the waaree energies share price. When the renewable sector attracts capital inflows and policy support, companies like Waaree benefit, which is then reflected in stronger stock valuations and long-term investor confidence.

Recent Performance of Waaree Energies

In recent years, Waaree Energies has reported consistent growth in revenue and profitability. Strong order inflows, large-scale contracts, and partnerships have boosted its performance, resulting in greater investor attention. Whenever the company announces new projects, expansions, or financial milestones, the waaree energies share price tends to reflect these developments.

For instance, strategic collaborations with international renewable energy firms and government-backed initiatives often lead to upward movements in the share price. Conversely, challenges such as global supply chain disruptions or rising raw material costs may temporarily impact the stock’s performance.

Factors Influencing Waaree Energies Share Price

Like any publicly traded stock, the waaree energies share price is influenced by multiple internal and external factors. These include the company’s quarterly results, demand for solar panels, policy changes in the renewable energy sector, and global economic conditions. Other elements, such as investor sentiment, foreign institutional investor (FII) participation, and sector-specific news, also play critical roles.

For example, if the government introduces favorable policies such as subsidies or tax incentives for renewable energy projects, Waaree’s share price may surge. On the other hand, global uncertainties like fluctuating commodity prices or geopolitical tensions could create short-term volatility.

Government Policies and Their Role in Share Price Movements

The Indian government has been proactive in promoting renewable energy, with ambitious targets for solar power capacity installation. This favorable policy environment acts as a catalyst for companies like Waaree Energies. Programs such as “Make in India” and incentives for solar panel manufacturing give a significant boost to the company’s operations.

The waaree energies share price benefits whenever policy changes directly support growth in the renewable energy sector. For instance, announcements regarding solar tenders, subsidies, or grid development often trigger positive sentiment among investors, thereby pushing the share price upward.

Investor Sentiment Toward Waaree Energies

Investor sentiment plays a crucial role in stock market dynamics. For Waaree Energies, the perception of being a market leader in solar manufacturing drives optimism among both retail and institutional investors. The waaree energies share price often reflects this sentiment, rising during times of positive news flow and strong earnings reports.

Investor sentiment plays a crucial role in stock market dynamics. For Waaree Energies, the perception of being a market leader in solar manufacturing drives optimism among both retail and institutional investors. The waaree energies share price often reflects this sentiment, rising during times of positive news flow and strong earnings reports.

Analysts frequently highlight Waaree’s strong growth prospects, which further attract new investors into the stock. At the same time, cautious investors carefully monitor industry risks, ensuring that share price movements are balanced between optimism and pragmatic analysis.

Competitor Analysis and Its Effect on Waaree Energies Share Price

The renewable energy industry is highly competitive, with both domestic and global players vying for market share. Competitors such as Adani Green Energy, Tata Power Solar, and Vikram Solar often influence the overall sector performance. When rival companies report strong financials or bag large projects, it may temporarily impact the waaree energies share price by altering investor sentiment across the sector.

Waaree’s robust production capabilities, diversified portfolio, and brand credibility often help it maintain a strong position even amidst competition. Investors also compare valuation metrics with competitors to assess whether Waaree is undervalued or overvalued in the market.

Financial Performance and Its Link to Share Price

Financial results remain the backbone of any stock’s performance. For Waaree Energies, strong revenue growth, profitability, and margin expansion directly contribute to investor confidence. The waaree energies share price typically responds positively to quarterly and annual earnings reports that surpass market expectations.

Key financial indicators such as earnings per share (EPS), return on equity (ROE), and operating margins are closely tracked by analysts. Strong financial health signals long-term sustainability, which usually translates into upward movements in the share price. Conversely, missed targets or unexpected losses may cause temporary declines.

Technological Advancements and Innovation Impact

Innovation is another vital factor driving Waaree Energies’ market strength. The company invests significantly in research and development to produce high-efficiency solar modules. Technological breakthroughs not only boost demand for Waaree’s products but also strengthen its competitive advantage. When the company announces new products or technologies, the waaree energies share price often reacts positively, as investors see innovation as a sign of long-term growth potential. Given that renewable energy technology evolves rapidly, Waaree’s ability to stay ahead of the curve directly influences its valuation in the stock market.

Global Expansion Strategy and Share Price Implications

Waaree Energies has steadily expanded its global footprint, exporting solar modules to several international markets. Global expansion increases revenue diversification, reduces dependence on domestic demand, and enhances the company’s brand recognition. Investors view this strategy as a sign of resilience and growth, which positively impacts the waaree energies share price.

For example, successful entry into European, American, and African markets demonstrates Waaree’s capability to meet international standards. Each milestone in global expansion creates investor enthusiasm, reflected in higher share price movements.

Impact of ESG Investing on Waaree Energies

Environmental, Social, and Governance (ESG) investing has gained immense traction in global financial markets. Investors are increasingly aligning portfolios with companies that meet sustainability standards. Waaree Energies, being a renewable energy leader, naturally benefits from this trend. The waaree energies share price often gains momentum as ESG-focused funds allocate capital toward green companies. With Waaree’s operations directly contributing to environmental goals, it stands out as an attractive option for long-term investors who prioritize sustainable investing strategies.

Risks That Could Affect Waaree Energies Share Price

Despite strong prospects, it is important to acknowledge the risks associated with investing in Waaree Energies. The waaree energies share price may face challenges due to factors such as fluctuating raw material costs, changes in government policies, or increased competition. Additionally, global events such as trade restrictions, currency fluctuations, or supply chain disruptions could create downward pressure.

Investors must also consider execution risks, including delays in project completion or unexpected regulatory hurdles. Understanding these risks is essential for making informed investment decisions.

Market Predictions and Analyst Views

Market analysts frequently provide projections on Waaree Energies’ growth trajectory, which influences investor expectations. Many analysts remain bullish on the stock due to strong fundamentals, sectoral growth, and policy support. Predictions about the waaree energies share price often suggest steady growth over the medium to long term. However, analysts also caution about short-term volatility driven by external factors such as interest rate fluctuations and global commodity trends. Investors who consider both bullish and cautious perspectives are better equipped to manage risks and returns.

Long-Term Investment Potential of Waaree Energies

Long-term investors view Waaree Energies as a promising stock due to its alignment with global renewable energy trends. With increasing demand for solar energy and government-backed support, the company is expected to maintain strong growth. The waaree energies share price is projected to benefit from this long-term demand, making it attractive for investors who prefer stable, future-oriented investments. The company’s expansion plans, robust order book, and emphasis on innovation further solidify its position as a stock with substantial long-term potential.

Waaree Energies and Retail Investor Participation

Retail investors have shown growing interest in renewable energy stocks, including Waaree Energies. The relatively accessible pricing of renewable energy shares and the long-term growth story attract small and medium investors. The waaree energies share price often sees increased volatility during periods of high retail trading activity, as these investors are more reactive to news and short-term developments. However, this increased participation also enhances liquidity, making the stock more attractive for all types of investors.

Role of Institutional and Foreign Investors

Institutional investors, including mutual funds and foreign institutional investors (FIIs), significantly influence the waaree energies share price. Large-scale buying or selling by such investors creates noticeable shifts in the stock price. Waaree’s strong fundamentals and presence in the high-growth renewable sector often attract institutional interest, providing stability and upward momentum to the stock. Foreign investors, in particular, are drawn to India’s renewable energy growth story, and Waaree’s strong export strategy makes it an appealing investment choice.

Conclusion: The Outlook for Waaree Energies Share Price

The journey of Waaree Energies reflects the broader story of India’s renewable energy revolution. With its strong manufacturing capacity, innovative approach, and alignment with sustainability goals, the company has established itself as a key player in the solar energy market. The waaree energies share price serves as a barometer for its growth, challenges, and future potential.

While short-term fluctuations are inevitable due to market conditions, the long-term outlook remains promising. For investors seeking exposure to renewable energy, Waaree Energies represents both an opportunity and a responsibility—an opportunity for financial returns and a responsibility toward a greener future.

Also Read: xson208